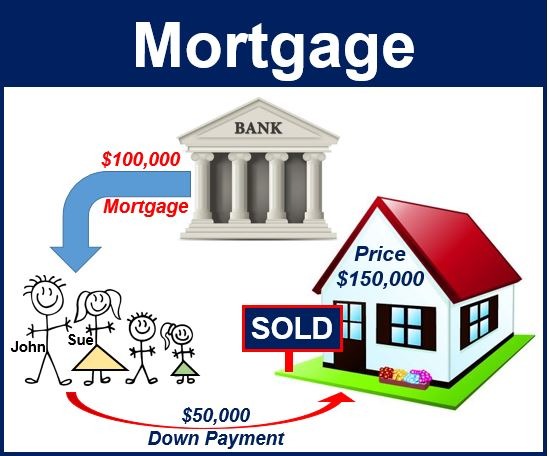

Explaining: What is Mortgage? Detailed explanation A mortgage is a financial product that allows individuals to borrow money to purchase real estate, typically a home. It is a loan secured by the property being purchased, meaning that if the borrower fails to repay the loan, the lender has the right to take ownership of the property through a process known as foreclosure. This long-term loan is one of the most common ways people finance the purchase of their homes, as most individuals do not have the necessary funds to buy a property outright.

What is Mortgage? Detailed Explanation.

At its core, a mortgage is a type of secured loan where the borrower receives a lump sum from a lender and agrees to repay that amount, with interest, over a specified period. The repayment schedule is typically spread over 15, 20, or 30 years, though other terms can be negotiated. The mortgage agreement is a legally binding contract that outlines the terms and conditions under which the borrower must repay the loan.

The property itself acts as collateral for the loan, which means that the lender has a legal claim on the property if the borrower defaults on the loan. This security reduces the risk to the lender, allowing them to offer lower interest rates compared to unsecured loans.

2. Components of a Mortgage

Discussing: What is Mortgage? A mortgage is composed of several key components, each of which plays a vital role in how the loan functions:

- Principal: The principal is the amount of money borrowed by the homeowner. For example, if a homebuyer borrows $200,000 to purchase a house, the principal amount of the mortgage is $200,000. The principal decreases over time as the borrower makes payments.

- Interest: Interest is the cost of borrowing the principal. It is usually expressed as an annual percentage rate (APR). Interest rates can be fixed, meaning they stay the same throughout the loan term, or adjustable, meaning they can change at specified intervals.

- Term: The term of the mortgage is the length of time the borrower has to repay the loan. Common mortgage terms are 15, 20, or 30 years. A longer term typically means lower monthly payments but more interest paid over the life of the loan.

- Down Payment: The down payment is the initial amount the borrower pays upfront toward the purchase of the property. It is usually expressed as a percentage of the property’s purchase price. A common down payment is 20%, but it can be higher or lower depending on the loan type and borrower’s financial situation.

- Amortization: Amortization refers to the process by which the loan is gradually paid off over time through regular monthly payments. Each payment covers both interest and principal, with the interest portion being larger at the beginning of the term and decreasing over time, while the principal repayment portion increases.

- Escrow: Escrow is an account set up by the lender to collect and hold funds for property taxes and homeowners insurance. The borrower pays a portion of these costs along with their monthly mortgage payment, and the lender disburses the funds when the taxes and insurance are due.

3. Types of Mortgages

Discussing: What is Mortgage, There are several types of mortgages available, each with its own set of features and benefits:

- Fixed-Rate Mortgage: In a fixed-rate mortgage, the interest rate remains constant throughout the life of the loan. This predictability allows homeowners to budget more effectively, as they know exactly how much their mortgage payment will be each month.

- Adjustable-Rate Mortgage (ARM): An ARM has an interest rate that can change periodically based on market conditions. It usually starts with a lower interest rate than a fixed-rate mortgage, but the rate can increase or decrease over time, which may result in higher or lower monthly payments.

- Interest-Only Mortgage: In an interest-only mortgage, the borrower pays only the interest for a specified period (usually 5-10 years), after which they begin to pay both principal and interest. if you ask now What is Mortgage? This type of mortgage can be attractive to borrowers who want lower initial payments but may result in higher payments later.

- FHA Loan: Insured by the Federal Housing Administration (FHA), these loans are designed for low-to-moderate-income borrowers who may not qualify for conventional loans. FHA loans typically require a lower down payment and have more flexible credit requirements.

- VA Loan: Available to veterans, active-duty service members, and certain members of the National Guard and Reserves, VA loans are backed by the U.S. Department of Veterans Affairs and often require no down payment and have favorable interest rates.

- Jumbo Loan: Jumbo loans are used to finance properties that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans typically have stricter credit requirements and higher interest rates due to the larger loan amount.

- Reverse Mortgage: What is Mortgage? A reverse mortgage is available to homeowners aged 62 and older, allowing them to convert part of the equity in their home into cash without having to sell the property. The loan is repaid when the homeowner sells the home, moves out, or passes away.

4. Mortgage Process

Discussing: What is Mortgage, The mortgage process involves several steps, each of which is critical to ensuring that the loan is successfully completed:

- Pre-Approval: Before shopping for a home, it’s advisable to get pre-approved for a mortgage. During this process, the lender reviews the borrower’s financial situation, including income, credit score, and debt, to determine how much they can borrow. A pre-approval letter shows sellers that the buyer is serious and financially capable of purchasing the property.

- Home Search and Offer: Once pre-approved, the borrower can begin searching for a home. After finding a suitable property, they make an offer to the seller. If the offer is accepted, the purchase contract is signed, and the mortgage application process begins.

- Mortgage Application: The borrower submits a formal mortgage application(What is Mortgage), providing detailed information about their financial situation and the property being purchased. The lender will request documentation such as tax returns, bank statements, and proof of employment.

- Underwriting: During underwriting, the lender evaluates the borrower’s financial information and the property’s value to determine whether to approve the loan. The lender may require additional documentation or clarification during this stage. If the loan is approved, the lender will issue a commitment letter outlining the terms of the mortgage.

- Appraisal: The lender orders an appraisal to determine the fair market value of the property. This ensures that the loan amount does not exceed the value of the property. If the appraisal comes in lower than the purchase price, the borrower may need to renegotiate the price or provide a larger down payment.

- Closing: At the closing, the borrower signs the mortgage(What is Mortgage) documents and pays the closing costs, which include fees for the appraisal, title search, and other expenses. The lender disburses the loan funds to the seller, and the borrower becomes the owner of the property.

5. Costs Associated with Mortgages

Discussing: What is Mortgage, In addition to the principal and interest, there are several costs associated with obtaining a mortgage:

- Closing Costs: These are fees and expenses paid at the closing of a real estate transaction. Closing costs typically range from 2% to 5% of the loan amount and include fees for the appraisal, title search, title insurance, attorney’s fees, and recording fees.

- Private Mortgage Insurance (PMI): What is Mortgage? If the borrower makes a down payment of less than 20%, the lender may require PMI, which protects the lender in case the borrower defaults on the loan. PMI is usually paid as part of the monthly mortgage payment.

- Property Taxes: Property taxes are levied by local governments and are based on the assessed value of the property. The borrower typically pays a portion of the annual property tax bill along with their monthly mortgage payment, which the lender holds in escrow.

- Homeowners Insurance: Lenders require borrowers to have homeowners insurance, which protects the property against damage from events like fire, theft, and natural disasters. The cost of the insurance is typically included in the monthly mortgage payment.

- HOA Fees: If the property is located in a community governed by a homeowners association (HOA), the borrower may be required to pay monthly or annual HOA fees. These fees cover the cost of maintaining common areas and amenities.

6. Factors Influencing Mortgage Approval

Discussing: What is Mortgage, Several factors influence whether a borrower will be approved for a mortgage and the terms they receive:

- Credit Score: A higher credit score indicates a lower risk to the lender and can result in a lower interest rate. Lenders typically require a minimum credit score for different types of mortgages.

- Income and Employment History: Lenders prefer borrowers with a stable income and employment history. The borrower’s debt-to-income ratio (DTI) is also considered; a lower DTI indicates that the borrower has enough income to cover their debts and the mortgage payment.

- Down Payment: A larger down payment reduces the lender’s risk and can result in a lower interest rate and the avoidance of PMI. However, some loan programs allow for lower down payments.

- Property Type: The type and location of the property can influence the lender’s decision. For example, lenders may have stricter requirements for investment properties or properties in areas prone to natural disasters.

7. Risks and Considerations

Discussing: What is Mortgage, While a mortgage allows individuals to purchase a home without paying the full price upfront, it also comes with risks and considerations:

- Interest Rate Risk: For adjustable-rate mortgages, there is a risk that interest rates will increase over time, leading to higher monthly payments.

- Foreclosure Risk: If the borrower is unable to make mortgage payments, the lender can foreclose on the property, leading to the loss of the home.

- Market Risk: The value of the property may decrease over time, leading to negative equity, where the mortgage balance is higher than the property’s.

Read More articles on: injectorml